Contents

Understanding Second Charge Mortgages

In real estate and finance, second-charge mortgages have emerged as a valuable tool for homeowners looking to access the equity they’ve built in their properties. This comprehensive guide will delve into the world of second-charge mortgages, providing you with all the knowledge you need to make informed decisions about your financial future.

What is a Second Charge Mortgage?

Before we go any further, let’s clarify what a second charge mortgage is. Also known as a “second mortgage” or “secured loan,” it’s a financial product that allows homeowners to borrow money by using the equity in their property as collateral. Unlike a traditional mortgage, a second-charge mortgage doesn’t replace your existing mortgage; instead, it sits on top of it, giving you access to a lump sum or a credit line.

The Benefits of Second Charge Mortgages

Second-charge mortgages offer several unique advantages, making them a practical choice for various financial needs. Here are some key benefits:

3.1. Access to Equity: Perhaps the most significant advantage is tapping into the equity you’ve built in your home. Whether you want to fund home improvements, consolidate debts, or make a substantial purchase, a second-charge mortgage provides the financial means to achieve your goals.

3.2. Lower Interest Rates: Second-charge mortgages often come with lower interest rates than unsecured loans, making them a cost-effective solution for borrowing.

3.3. Flexible Repayment Terms: These mortgages offer flexibility in how you repay the borrowed amount. You can choose between fixed or variable interest rates and various term lengths to suit your financial situation.

3.4. No Impact on Your Existing Mortgage: A significant benefit is that taking out a second-charge mortgage does not affect your primary mortgage. Your first mortgage remains untouched, and you can continue your regular mortgage payments.

3.5. Potential Tax Benefits: Depending on how you use the funds from your second charge mortgage, there may be tax advantages, mainly if you invest in home improvements or use the money for business purposes.

When to Consider a Second Charge Mortgage

While second-charge mortgages offer numerous benefits, assessing when to consider this financial option is essential. Here are some situations where a second charge mortgage might be the right choice:

4.1. Home Renovations: A second-charge mortgage can provide the necessary funds to enhance your property’s value if you plan extensive renovations.

4.2. Debt Consolidation: Consolidating multiple high-interest debts with a second-charge mortgage can lower overall interest costs and simplify your finances.

4.3. Big Purchases: For significant expenses like a child’s education or a new vehicle, a second-charge mortgage can offer a more affordable financing solution than personal loans or credit cards.

4.4. Business Ventures: Entrepreneurs looking to invest in their business or embark on a new venture may find second-charge mortgages an attractive option for securing capital.

Subtitle 5: How to Obtain a Second Charge Mortgage

5.1. Consult with a Mortgage Broker: Consult a reputable broker specializing in second-charge mortgages. They can help you understand your options and find the best deal for your needs.

5.2. Eligibility Criteria: Lenders have specific criteria for approving second-charge mortgages, including your credit history, income, and the amount of equity in your property. Ensure you meet these requirements.

5.3. Comparison Shopping: It’s crucial to compare offers from multiple lenders to secure the most favorable terms and interest rates.

5.4. Application Process: Once you’ve chosen a lender, you must complete an application, provide documentation, and undergo a property valuation. The process typically takes a few weeks to complete.

Understanding Second Charge Mortgages

Second-charge mortgages offer a valuable solution for securing additional funding against your property. Unlike traditional first-charge mortgages, these financial products allow homeowners to access a lump sum or regular payments, using their home as collateral. This comprehensive guide will explore everything you need to know about second-charge mortgages, from how they work to their advantages and disadvantages.

How Second Charge Mortgages Differ from First Charge Mortgages

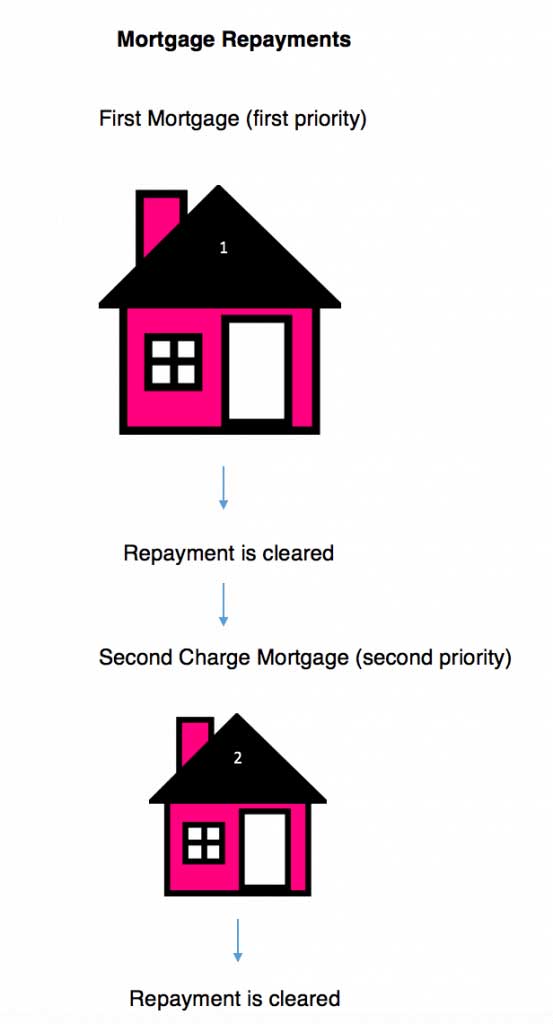

One of the primary distinctions between second-charge mortgages and first-charge mortgages is their position in the financial hierarchy. In this section, we’ll delve into the key differences between these two types of loans, helping you understand when a second-charge mortgage might be the right choice for you.

Benefits of Second Charge Mortgages

Second-charge mortgages offer several unique advantages for homeowners needing additional funds. This section will highlight the benefits of opting for a second-charge mortgage, from lower interest rates to more flexible borrowing limits. We’ll also discuss everyday use cases for these loans, such as home improvements and debt consolidation.

Risks and Considerations

As with any financial product, second-charge mortgages also have their fair share of risks. It’s essential to be aware of these potential downsides and carefully consider them before proceeding. This section will provide an in-depth analysis of the risks associated with second-charge mortgages, including the possibility of losing your home if you fail to meet your repayment obligations.

How to Apply for a Second Charge Mortgage

If you’ve decided that a second-charge mortgage is the right choice for your financial needs, the next step is understanding the application process. In this final section, we’ll guide you through the steps to secure a second-charge mortgage, from initial inquiries to the approval and disbursement of funds. You’ll also find tips on improving your chances of getting approved for this type of loan.

Second-charge mortgages can be a valuable financial tool for homeowners seeking additional funds. By understanding how they work, comparing them to first-charge mortgages, and weighing their benefits against potential risks, you can decide whether a second-charge mortgage is the right choice for your financial goals. If you choose to move forward, this guide will also provide the necessary information to navigate the application process successfully.

Ahammed World Afffaires

Ahammed World Afffaires